You could potentially be up for a nasty surprise if you are expecting to receive a high tax refund this year. So far this year the average refund is down over 8.4% compared to last year according to the IRS.

This is the first year of people filing their taxes since the new tax law under President Trump. The average refund is so far only $1,865 compared to $2,035 compared to previous years. Politico quoted Edward Karl, the vice president of taxation for the American Institute of CPAs;

“There are going to be a lot of unhappy people over the next month, Taxpayers want a large refund.”

Edward Karl

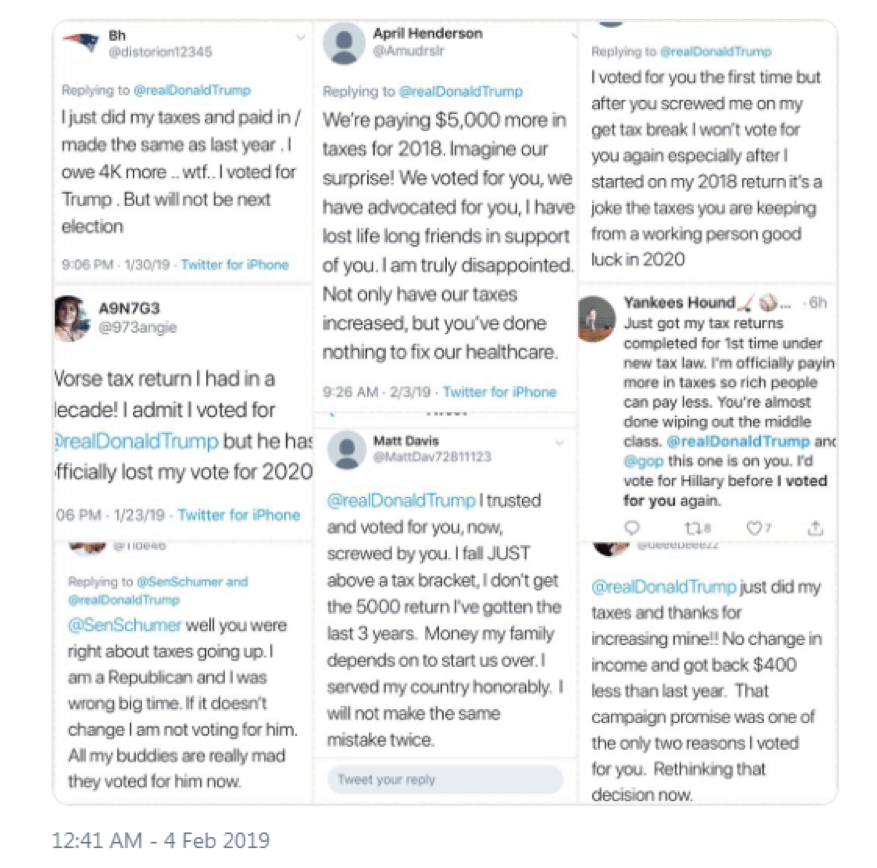

Usually ¾ of the tax filers in the U.S. receive a tax-refund. The fact that refunds are down and in some cases not existent have created outrage amongst lot of tax-payers. Plenty of tax-payers have gone to social media to complain about the lower tax-refund this year. Most people have been expecting higher tax-refund as President Trump said the new tax law would result in lower taxes for people. So far this does not appear to be the case.

One of the main reason that people are getting lower refunds is that insufficient withholdings were made to taxpayers’ pay-checks in 2018. For the IRS it is often easier to issue re-funds than to collect additional money.

Unfortunately, due to the all the changes that the new Trump tax bill, initially taxpayers thought they are paying lower taxes due to lower withholdings from their paychecks while in reality, nothing had really changed. Now that actual filings are due, people are noticing much lower tax refunds or even potentially owing money to IRS.

With this said, it is important that you as a tax-payer look at your filings to get a better assessment what will happen to your tax-refund this year. Below are some of the main changes to the taxes for 2019.

Changes for taxes for 2019

- State and

local Taxes: The state andlocal tax deduction, also known as SALThas been changed. The SALT deductions have been extremely popular and used in big states such as New York, Illinoisand California. Until this year, as ataxpayer you could deduct ALL state and local taxes from their federal taxes. This deductionhave been capped $10,000 starting taxes filed in 2019. - Medical Expenses: Previously qualified medical expenses up to

7.5% of a tax payer’s adjusted gross income could be claimed. This limit

have increased to 10% for 2019. Forexample if you make $100,000 you could previously deduct medical expenses that exceed $7,500. Now the threshold is $10,000. - Mortgages: Mortgage interest deductions have a lower

threshold than before. Previously, interest on new mortgages of up to $1m could

be written off. This threshold

have now been lowered to only $750,000.

Write-offs to do

- Charitable Contributions: You can deduct up donations to the value of up to 60% of your income. As always, make sure you have receipts for all the deductions you end up doing.

- Retirement Plan Contributions: Payments that you do to your traditional IRAs and Simplified Employee Pension plans (SEPs) may be deductible. This does not apply for Roth IRAs.

- Personal Property Taxes: As a

taxpayer you can deduct personal property taxes on items such as boats, cars. This deduction can only be used if there yearly taxes on these properties and are based on the value of the assets. Starting this year this also falls under the $10,000 limit for income, sales and property taxes per the TCJA. - Health Savings Account (HSA) Contributions: If you have a high

deductible healthcare plan, you can then contribute to

an HAS tax-free. Furthermore, your withdrawals are tax-free as long as you use them for qualified medical expenses. - Self-Employment Expenses: For the people that are self-employed, they can deduct up to 50% of the payroll taxes. In some cases, one can also deduct retirement contributions and health insurance expenses and other expenses such as a home office.

Easily avoided mistakes

Beyond that we have noted when comes to changes and write-offs you can do, we have below written a couple easy mistakes to avoid when filing your taxes.

- Wrong Filing Status: If you are

single parent, you might want to pick to file as head of household filing status instead of being single. It comes withlarger standard deduction and potentially lower tax-rate. To qualify for this status you need to;- Not be married

- Pay for more than 50% of the financial support of your household

- Have your children live with you more than half of the year

- File without all relevant documents: Be certain you file all relevant tax-documents, such as all employee W-2s , 1099 forms or any other form that you can claim deductions or credits. For examplewe previously discussed credits you can receive from Student Loans here.

- Big Life Events: Big life events such as having children, marriage or divorce could potentially materially affect your tax filing status and potential write-offs, credits, and deductions you can do. Finally, please note, all these things could potentially lead that you could either move up or down a tax-bracket which can affect your returns.

- Mistakes with typing/writing in Incorrect Info: A simple typo, beyond the spelling your name incorrectly, or writing wrong social security number can be painful. For example if you write the wrong bank account number for your direct deposit, the IRS would not know this until the refund is rejected from your bank. In addition, if you write in wrong income amount, the IRS will not be able to correct this until they receive your income information from your employer.

As this year will be the first year with the new tax-law, there a high likelihood that your refund could be lower, or even worse you have to pay additional taxes. To be sure to avoid this, please properly go through your tax-filings, making sure you are aware of the new changes, what deductions you can do and how to avoid common mistakes. We have also previously written about how you can save on your taxes if you have children and if you have student loans.